How to use the feeling of the market for a successful exchange: unlock the power of cryptocurrency

The cryptocurrency, a decentralized digital currency, has gained popularity in recent years. While its introduction and use continue to grow, retailers are looking for ways to maximize their profits and at the same time minimize the losses. An effective way to achieve this is to analyze the feeling of the market with the help of cryptocurrency.

What is the feeling of the market?

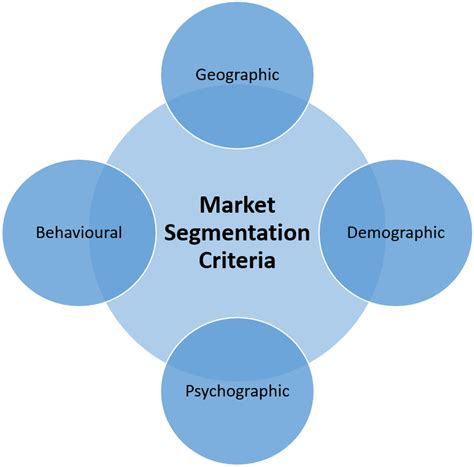

The feeling of the market relates to the collective attitude of investors and dealers compared to a certain class or a certain market for assets. It is a measure of the way individuals and optimistic or pessimistic institutions affect an investment, depending on their expectations and opinions. The feeling of the market can be expressed through various measures, including:

- Bollinger stripes: an indicator based on volatility, which measures the difference between the upper and lower Bollinger band values.

- Relative Force Index (RSI)

: An impulse soscillator that measures the strength of the price movement of a share compared to its price range over time.

- Divergence of the mobile average convergence (MACD) : An indicator that draws the relationship between two mobile average values and contributes to identifying potential trends and outbreaks.

Successful use of the success market school

In this article we will examine how the feeling of the market can be used to make well -founded commercial decisions in the markets of cryptocurrencies.

- Identify positive feelings

: Search for optimistic investors about a class of cryptocurrency or certain active ingredients. This can be done by analyzing similar assets, reading new financial and articles and renowned sources.

- Determine the negative feelings : Conversely, identify those who are lower or pessimistic when investing. This can be done by monitoring social media, online forums and the media that tend to spread a negative feeling towards a certain asset class.

- Use technical indicators : Combine the feeling of the market with technical indicators to create a more complete picture of the mood on the market.

Popular cryptocurrency trading strategies

Here are some popular trade strategies that integrate the feeling of market:

- Average reverse strategy : This strategy is to determine the conditions for border or appearance in a cryptocurrency market and to take long / short positions accordingly.

- Trend according to strategy : Based on RSI, MacD and other technical indicators, this strategy identifies trends and adapts transactions to align yourself with the underlying trend.

- Strategy beach trading : This strategy is to identify the support and level of resistance based on Bollinger stripes, an index of the relative strength or other indicators based on volatility.

- Commercial strategy based on news : Dealers use the titles of news, articles and analysis of feelings for social media to identify potential negotiation options.

Example of trading plan

To illustrate how the feeling of the market for successful trading in cryptocurrencies can be used, let us create an example of a simple trading plan:

Assuming that you apply the average reversal strategy with a mobile average (MA), RSI of 50 and MACD. Your trade settings would look like this:

- Buy signal: Bollinger tapes over the relative strength index

- Sales signal: RSI crosses under 30

- Long position: When the average reversal strategy shows an upward trend

Diploma

The feeling of the market offers a precious tool for cryptocurrency dealers to better understand the trends and opportunities on the market. Through the analysis of positive and negative feelings, using technical indicators and using these strategies, you can increase your chances of carrying out successful transactions.

However, it is important to remember that the feeling of the market is not infallible and that the trade contains inherent risks.