Effective risk management techniques for encrypting dealers

The world of cryptocurrency trading is known for its high volatility and unpredictability. Rapid price fluctuations, market decline and regulatory changes can be difficult on markets. In this article, we will discuss effective risk management techniques for cryptocurrency traders to help protect their capital and achieve their financial goals.

Why risk management is crucial in cryptocurrency

The trading of cryptocurrencies involves risks that are not repeated in traditional investments. Great volatility of the crypto currency can lead to significant losses if not properly managed. Without proper risk management, even the best traders may undergo considerable losses due to market fluctuation, regulatory changes or unexpected events.

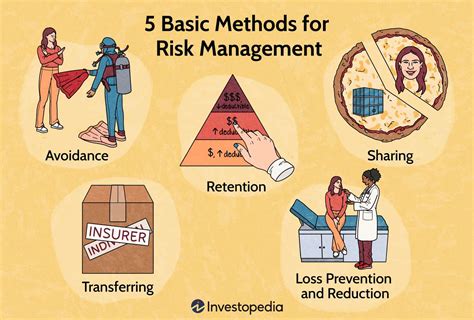

Common Risk Management Techniques for Crypto traders

- Position size : This includes determining how much capital to allocate each store. It is important to set real borders and avoid excessive treatment of your position.

- Stopping commands : These orders automatically sell an investment if they drop below a particular price, limiting potential losses.

- Profit check commands : Configure stop commands for each profit purpose, allowing you to block, at the same time, a minimizing influence on market falls.

- Protective strategies : This includes the use of derivatives or other tools to reduce the risk by deviating losses with profits from another store.

- Diversification

: Spread -Investments in different assets and markets to reduce exposure to any market or sector.

Technical technical techniques

- Graphic forms : Identify potential procurement/sales signals, using indicators such as media, relative resistance index (RSI) and Bollinger.

- Follow the tendency

: Place the trading strategy based on the direction of price movement and adjust it accordingly.

- Middle Reversion : Identify the conditions overloaded or reversed and bet against them.

Basic analysis techniques (FA)

- Economic indicators : Follow key economic indicators, such as GDP, inflation and interest rates to predict market trends.

- Company efficiency : Analyze the financial companies, the product management team and the product offer to determine its growth potential.

Risk management tools

- ** s

- Risk management platforms : Expense risk management tools, such as the LiquoPool or Bitmex risk risk management system.

- Criptic exchanges : Use the exchange such as binance or coinbase, which offers features of risk management.

Best practices for effective crypto risk management

- Educate -va : continuous learning about markets, cryptocurrency coins and trading strategies.

- Remain discipline : Keep strategies and avoid impulsive decisions based on emotions or short -term fluctuations on the market.

3

- Auxiliary market supervision : Attention to global events, regulatory changes and economic indicators that can affect the market.

- Refer to -va and update -va strategy : Continuously evaluate your trading strategy efficacy and adjust it as required.

Conclusion

Effective risk management is crucial for cryptocurrencies to protect their capital and to achieve its financial goals. By applying these techniques, using technical analysis tools and adopting the best practices, you can reduce the risks associated with cryptocurrency trade and increase the chances of success in these rapid development markets.