Evaluating the Risk-Read Ratio in Crypto Investments

The world of cryptocurrencies has been a wild ride for investors and enthusiasts alike. The rise of Bitcoin, Ethereum, and other altcoins has created a vast market with potential returns that are tantalizingly high. However, it’s essential to separate hype from reality when it comes to invest in cryptocurrency. One critical aspect to consider is the risk-reward ratio, which can make or break your investment decisions.

What is the Risk-Read Ratio?

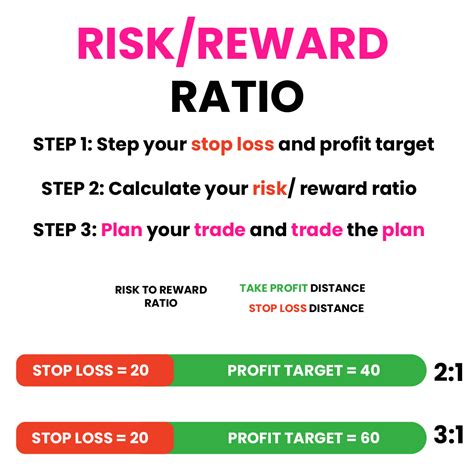

The risk-reward refers to the relative value of potential gains against potential losses for a given investment opportunity. (Or Lose) A higher reward-to-risk ratio indicates that an investable, while a lower ratio sucgests that the risks outweigh the potential benefits.

Why is the Risk-Reatio Important?

When evaluating the cryptocurrency market, the risk-reward ratio is crucial for making informed decisions. IT HELP INVESTORS:

1.

2.

*

How to evaluate the Risk-Reatio

Investment:

1.

- Review the team and leadership

: Assess the expertise and experience of the management and development teams.

.

- Analyze the tokenomics : Study the Token’s Supply, Distribution, and usage patternns to understand its potential for growth.

Examples of High-Read Cryptocurrencies

Several cryptocurrencies have demonstrated high reward-to-risk ratios in the past:

- Dogecoin (doge) :

.

Examples of Low-Reward Cryptocurrencies

Conversely, some cryptocurrencies have demonstrated lower reward-to-risk ratios:

- Litecoin (LTC) :

2.

Conclusion

Evaluating the risk-reward ratio in cryptocurrency investments requires a thorough understanding of the market and the specific project being considered. By Assessing the reward-to-risk ratio, investors can make more decisions about their investments and set realistic expectations. While it is essential to take calculated risks, a clear understanding of the potential rewards and losses is crucial for achieving long-term success.

Recommendations

To maximize your investment returns in cryptocurrency:

- Diversify your portfolio : Spread your investments across different cryptocurrencies to minimize risk.

- Set Stop-Loss Levels : Establish Clear Limits on Potential losses to avoid significant financial setbacks.

3.