Future of Finance: Cryptocurrency Manager, KYC (Know Your Customer) Requirements and Trade Scope in Digital Markets

In recent years, cryptocurrency has become a significant participant in the global financial market. With a great return on investment and decentralization from traditional institutions, cryptocurrencies drew the attention of investors around the world. However, browsing in the complex world of cryptocurrency trading is not just about understanding its technology-there are strict rules and requirements that need to be met to ensure that the fight against money laundering (AML) and knowledge and your customer (KYC) laws are complied with. ;

Who is your customer?

Know-Classe or Kyc is a process that financial institutions use to verify the identity and confirm its legality. The abbreviation means “know”, “you”, “client”. When it comes to cryptocurrency trade, KYC is very important as it helps prevent illegal activities such as money washing, terrorist financing and other forms of financial crime.

KYC Requirements for Trading in Cryptocurrency Trading

Investors must submit a personal and determine the information by opening the account by opening the KYC rules related to cryptocurrency trading. This usually includes the provision:

1

- Address

: Physical address or digital wallet that can be used as a virtual address.

- Phone number and email Email : Checking a person’s contact information through phone calls or email Letters.

- Bank Account Information : Transfer of funds to the cryptocurrency wallet applies to KYC provisions, requiring investors to provide detailed bank account information.

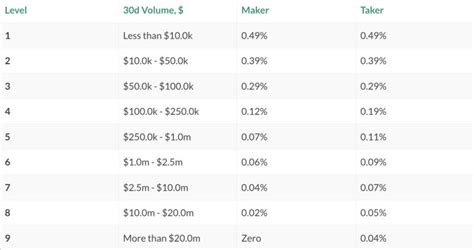

Trade volume: Main Retirement Indicator

When it comes to assessing market activities, trade volumes play an important role in determining whether the property has gained or lost value. The volume of trade refers to the total amount of assets with which it is traded over a period of time (eg day, week, month). The large volume of trade indicates that more people buy or sell property, which can increase price changes.

Cryptocurrency Types

There are two main types of cryptocurrency trading:

- Spot Trade : Buying and Selling Cryptocurrencies at current market prices.

2.

the volume of trade in future markets

In the future markets, the volume of trading means the total number of contracts traded over a period of time (eg day, week, month). The large volume of trade indicates that more people buy or sell contracts, which can lead to increased prices. Some of the noticeable trading trends of cryptocurrencies include:

- Increased adoption : When more institutional investors and risk insurance funds get on the market, trade volumes have increased significantly.

2.

- Market mood : The volume of trade can affect the market mood, while buyers and sellers show different levels of enthusiasm on certain assets.

Conclusion

In conclusion, cryptocurrency trade is a complex area that requires strict rules such as KYC requirements, and high trading rates such as future markets. By understanding the knowledge of their customer’s processes and analysis of trends in these markets, investors can make reasonable decisions on their investment strategies.