The role of market producers in AAVE trade: Unlocking the power of liquidity and efficiency

In the cryptocurrency world, market producers play a crucial role in facilitating the purchase and sale of digital assets. Among the many available cryptocurrencies, AAVE (previously known as AAVE Protocol) has become an increasingly popular platform to trade more financial instruments. In this article, we will deepen the role of market creators in AAVE trade, exploring their benefits, strategies and challenges.

What are market producers?

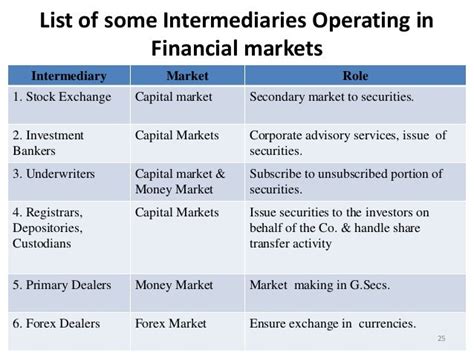

Market producers, also known as liquidity suppliers, are entities that maintain a stable balance of buying and selling an asset in a certain price range. They act as intermediaries between buyers and sellers, providing liquidity on the market, making orders at predominant prices. In other words, market producers allow users to exchange cryptocurrencies without having to buy or sell them directly.

The role of market producers in AAVE

In the context of AAVE, market producers play an essential role in facilitating the trade of several financial instruments, which include:

- Lichidity provision : When providing liquidity, market manufacturers ensure that buyers and sellers can enter and exit operations at prevalent prices.

- Price discovery : Market producers help to determine the value of assets, making orders at stable prices, which allows traders to make knowledge of the case regarding purchase or sale.

- Risk management : Market producers act as risk managers, alleviating possible losses associated with market volatility.

- Efficiency : Offering liquidity and facilitaries operations, market producers reduce transaction costs and increase the efficiency of the negotiation process.

Types of market producers

There are several types of market producers in AAVE, which include:

- market producers (MMS) : These are market producers for a private asset on the AAVE platform.

- Cross -market creators : These are market producers who are trading between two or more different assets, such as AAVE and LIDO.

- Manufacturers’ creators : These are market producers who change both addresses (producers) in the price range of an asset.

Strategies used by market producers

Market manufacturers use various strategies to achieve their goals in the Ave Ecosystem:

- Order card management : Manage the order book, ensuring that the exchanges are executed at predominant prices.

- Difference management : I maintain a stable differential between supply prices and demand to guarantee market efficiency.

- Position size : It regulates its position dimensions to minimize potential losses or to maximize profits.

Challenges facing market producers

While market producers play a vital role in facilitating AAVE trade, more challenges are faced:

- Regulatory risks : Market producers must meet the regulatory requirements, which can be complex and slow.

- Market volatility : Changes in market conditions can affect their income or profitability flows.

- Competition : AAAA market is extremely competitive, and market producers need to differentiate to attract and retain customers.

Conclusion

The role of market producers in the AAVE trade is multiplied, offering liquidity, discovering prices, risk management and traders efficiency. Understanding the strategies used by market producers and the challenges they face, traders can better sail for the Ave ecosystem and maximize their potential yields. As the demand for stable and decentralized financial instruments continues to increase, the importance of market producers to facilitate these operations will continue to grow.